Enlarge image

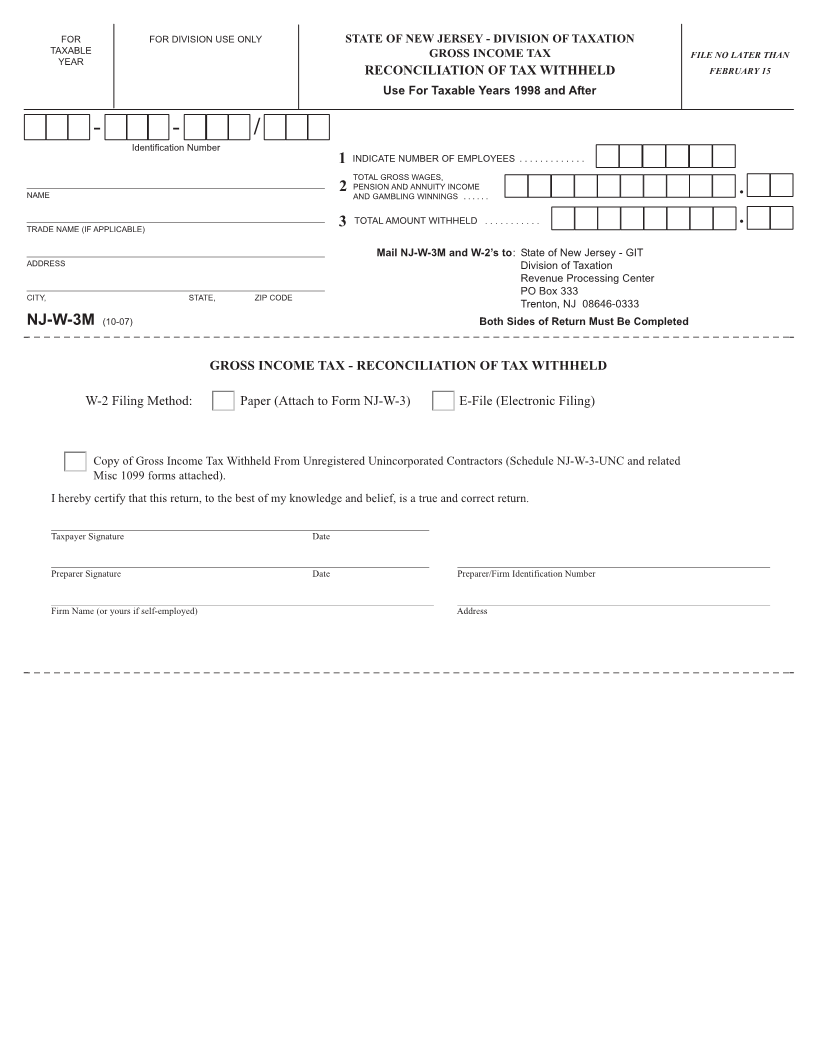

FOR FOR DIVISION USE ONLYSTATE OF NEW JERSEY - DIVISION OF TAXATION

TAXABLE GROSS INCOME TAX FILE NO LATER THAN

YEAR

RECONCILIATION OF TAX WITHHELD FEBRUARY 15

Use For Taxable Years 1998 and After

- - /

Identification Number

1INDICATE NUMBER OF EMPLOYEES . . . . . . . . . . . . .

TOTAL GROSS WAGES,

___________________________________________________________________PENSION AND ANNUITY INCOME

NAME 2AND GAMBLING WINNINGS . . . . . . •

___________________________________________________________________3TOTAL AMOUNT WITHHELD . . . . . . . . . . . •

TRADE NAME (IF APPLICABLE)

___________________________________________________________________Mail NJ-W-3M and W-2’s to: State of New Jersey - GIT

ADDRESS Division of Taxation

Revenue Processing Center

___________________________________________________________________PO Box 333

CITY, STATE, ZIP CODE

Trenton, NJ 08646-0333

NJ-W-3M(10-07) Both Sides of Return Must Be Completed

GROSS INCOME TAX - RECONCILIATION OF TAX WITHHELD

W-2 Filing Method: Paper (Attach to Form NJ-W-3) E-File (Electronic Filing)

Copy of Gross Income Tax Withheld From Unregistered Unincorporated Contractors (Schedule NJ-W-3-UNC and related

Misc 1099 forms attached).

I hereby certify that this return, to the best of my knowledge and belief, is a true and correct return.

_________________________________________________________________________________

Taxpayer Signature Date

_________________________________________________________________________________ ___________________________________________________________________

Preparer Signature Date Preparer/Firm Identification Number

__________________________________________________________________________________ ___________________________________________________________________

Firm Name (or yours if self-employed) Address