Enlarge image

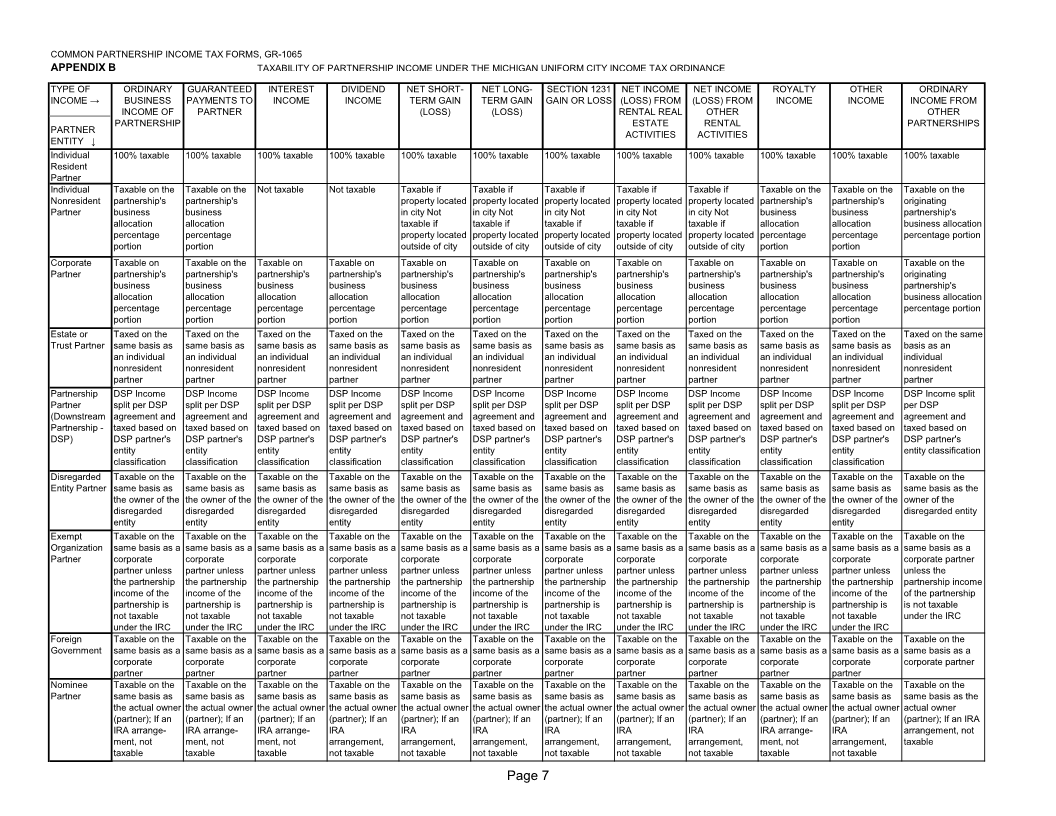

Taxability of Partnership Income under the Michigan

Uniform City Income Tax Ordinance

Partnerships Required to File a Return

Every partnership with business activity in the city, whether or not

an office or place of business was maintained in the city, is

required to file an annual return. Syndicates, joint ventures, pools

and like organizations and Limited

City of Grayling Liability Companies (LLC's) electing to be taxed as partnerships at

the federal level will also use Form GR-1065.

1020 City Boulevard, Grayling, MI 49738

Partners who are individual RESIDENTS are taxed on their

entire distributive share of the net profits of the partnership,

including that arising from business activities outside the city:

ordinary business income, interest income, dividend income,

rents, royalties, other income, and gains from the sale or

exchange of property, either tangible or intangible, regardless of

where the property is located.

Partners who are individual NONRESIDENTS including

estates and trusts are taxed on their distributive share of the

201 9Partnership partnership’s ordinary business income which is attributable to

business activity in the city, plus net rentals of tangible property

located in the city and gains from the sale or exchange of tangible

Income Tax Return property in the city. Nonresidents are not taxed on their share of

net rentals of property located outside the city, gains from the sale

or exchange of tangible property located outside the city, gains

FORM GR-1065 from the sale or exchange of securities or other intangible

property, or non-business interest and dividend income.

When the receipt of interest and other intangible income is directly

related to the nature of the business, such interest, etc., is

business income taxable to a nonresident, and is to be included in

ordinary business income in Schedule A.

Partners who are CORPORATIONS are taxed at the corporate

tax rate on their distributive share of the partnership’s: ordinary

MAILING ADDRESS: business income attributable to business activity in the city; net

rentals of tangible property; and gains from the sale or exchange

CITY OF GRAYLING of tangible property attributable to business activity in the city.

INCOME TAX DEPARTMENT Thus, all taxable income of a corporate partner (net profits of a

corporation) is determined by the business allocation

PO BOX 549 percentage of the partnership.

GRAYLING, MI 49738 Partners who are PARTNERSHIPS, LLC’s electing to be taxed

as a partnership, JOINT VENTURES, ETC. (downstream

partnership) are taxed based upon their partner’s entity

classification and share of partnership income.

CITY WEBSITE: DUE DATE OF PARTNERSHIP RETURN

Calendar year taxpayers must file by April 30, 2020. Fiscal

WWW.CITYOFGRAYLING.ORG year taxpayers must file by the last day of the fourth month

after the end of their fiscal year or short period return.

EXTENSION OF TIME TO FILE A PARTNERSHIP RETURN For

partnerships electing to pay tax, Form GR-7004, Automatic

We encourage questions. Extension of Time to File Certain Business Income Tax, Information

and Other Returns, must be filed on or before the due date for filing

Email: incometax@cityofgrayling.org the partnership return. An extension is automatically granted upon

filing of Form GR-7004 and payment of the tentative tax balance

Phone: (989) 348-2131 x108 due (Form GR-7004, line 3). Failure to pay the balance due

invalidates the extension request. Interest and penalty will

Fax: (989) 348-6752 be assessed on taxes paid late even if an extension of time to

file is granted. For partnerships filing an information return, a six

month extension of time to file is automatically granted. Do not

file Form GR-7004, Application for Automatic Extension of Time to

File Certain Business Income Tax, information and Other Returns.

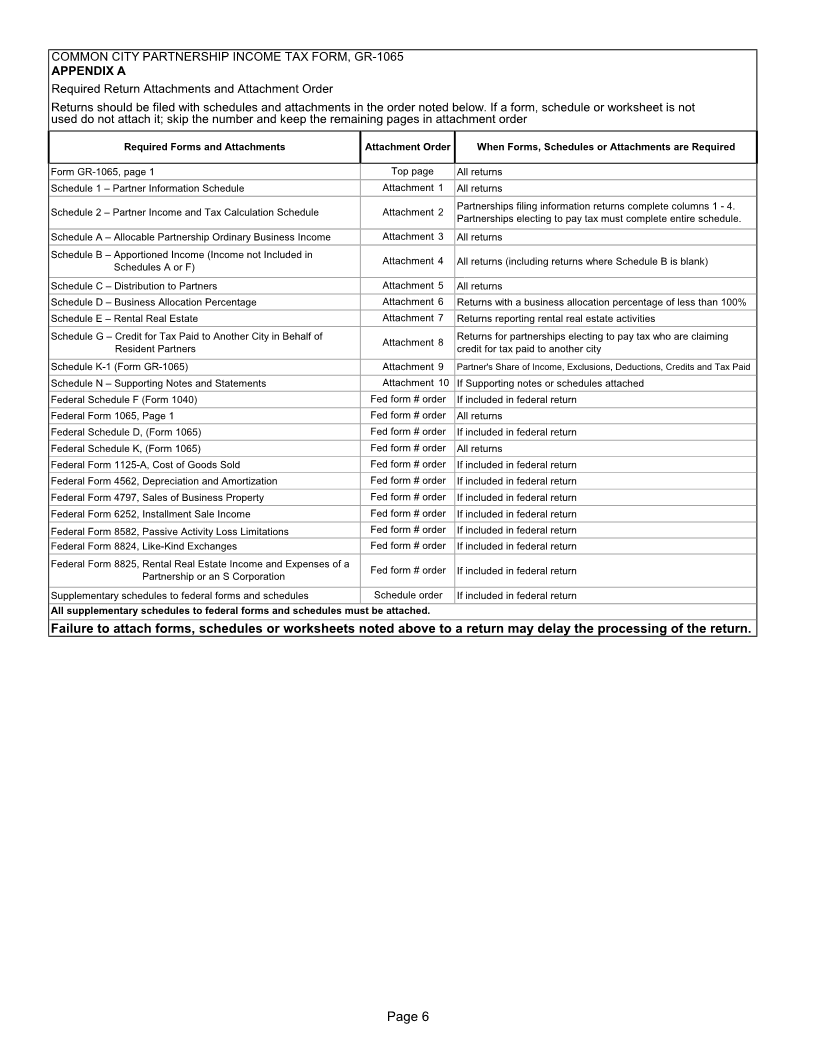

REQUIRED RETURN ATTACHMENTS

When filing a city’s partnership return, Form GR-1065, certain

schedules and copies of federal forms are required to be

attached. See page 6, Appendix A for a listing of attachments

GENERAL INFORMATION and attachment order.

Disclaimer OBTAINING PARTNERSHIP RETURN FORMS

These instructions are interpretations of the Uniform City Income Tax

Ordinance, MCLA 141.601 et seq. The Ordinance will prevail in any Partnership return forms are not mailed to partnerships. The

disagreement between these instructions and the Ordinance. forms are available for download on the city's website.

Page 1