Enlarge image

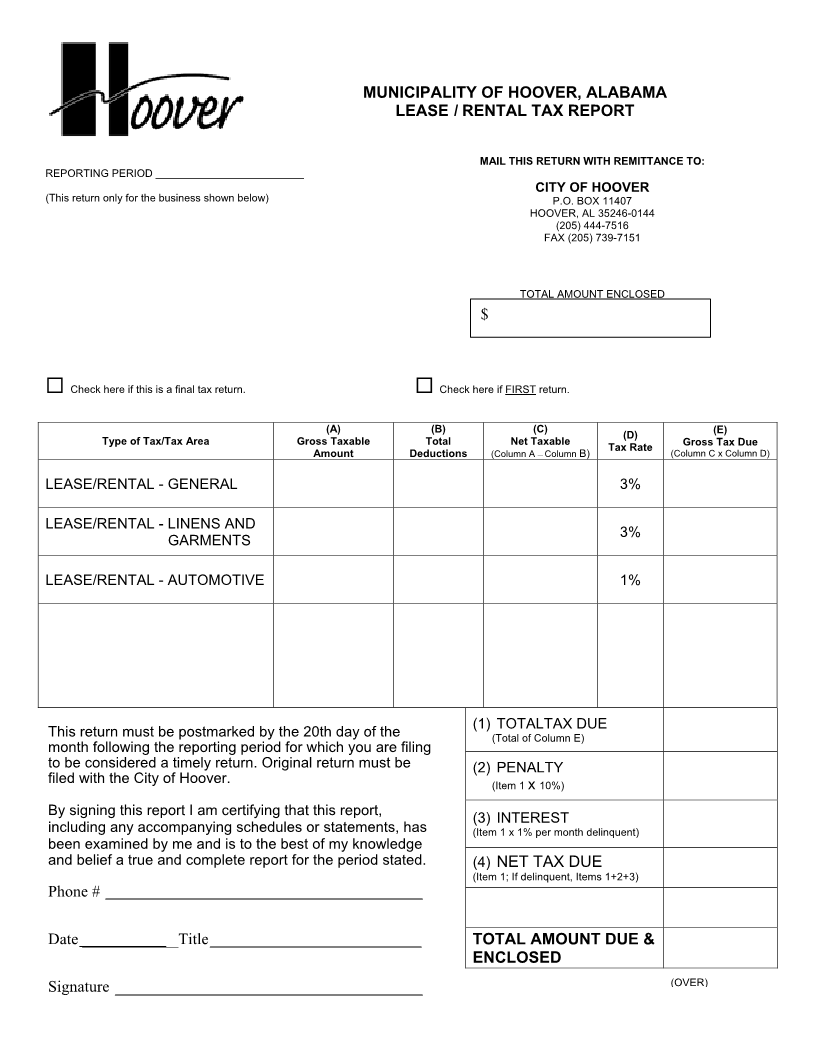

MUNICIPALITY OF HOOVER, ALABAMA

LEASE IRENTAL TAX REPORT

MAIL THIS RETURN WITH REMITTANCE TO:

REPORTING PERIOD _________________________

CITY OF HOOVER

(This return only for the business shown below) P.O. BOX 11407

HOOVER, AL 35246-0144

(205) 444-7516

FAX (205) 739-7151

TOTAL AMOUNT ENCLOSED

$

Check here if this is a final tax return.

Check here if FIRST return.

(A) (B) (C)

Type of Tax/Tax Area Gross Taxable Total Net Taxable (D) (E)

Amount Deductions (Column A —Column B) Tax Rate Gross Tax Due

(Column C x Column D)

LEASE/RENTAL - GENERAL 3%

LEASE/RENTAL - LINENS AND

3%

GARMENTS

LEASE/RENTAL - AUTOMOTIVE 1%

(1) TOTALTAX DUE

This return must be postmarked by the 20th day of the (Total of Column E)

month following the reporting period for which you are filing

to be considered a timely return. Original return must be (2) PENALTY

filed with the City of Hoover. (Item 1 x 10%)

By signing this report I am certifying that this report,

(3) INTEREST

including any accompanying schedules or statements, has (Item 1 x 1% per month delinquent)

been examined by me and is to the best of my knowledge

and belief a true and complete report for the period stated. (4) NET TAX DUE

(Item 1; If delinquent, Items 1+2+3)

Phone #

Date ____________Title TOTAL AMOUNT DUE &

ENCLOSED

(OVER)

Signature